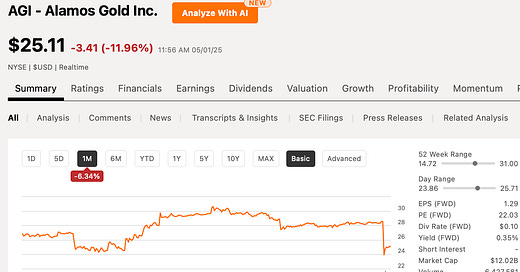

Alert! Quality Miner on Sale Rack -- Alamos Gold

Alamos Gold is exceptional among miners — and today, May 1st it is on sale!

This is just a quick note - in my opinion, this is an opportunity worth considering. Make your own decision after careful consideration. I already have…

The share price wobble today probably reflects ( a ) the overnight Chinese sale of 1 million ounces of gold on the market which depressed price of gold bullion, and ( b ) some transient ramp up problems at Alamos Magino and other mines.

Just a couple highlights for you to consider

Mineral Resource Growth Built In

Alamos is famous for accretive growth. It has a strong track record of consistent growing PER SHARE reserves — a rarity among miners— and a compelling factor

2024 Improvements

Year-end 2024 Mineral Reserves of 14.0 million ounces of gold (298 million tonnes ("mt") grading 1.45 grams per tonne of gold (“g/t Au”), a 31% increase from 2023

This marked the sixth consecutive year Mineral Reserves have grown for a cumulative increase of 44%

This growth in proven resource reflects the acquisition of Magino in 2024, continued high-grade additions at Island Gold, and an initial Mineral Reserve at Burnt Timber and Linkwood projects.

Future Growth

Alamos has a committed and funded plan to join the 1 Million Ounce club in the years ahead

Alamos is already at run-rate of 600,000 ounces per year.

As Alamos CEO outlines: “We expect this improvement to continue over the next several years through our portfolio of high-return, low-cost growth projects. The Phase 3+ Expansion ( of Island Mine ) continues to track well for completion in 2026, and with construction activities ramping up on Lynn Lake and PDA this year, we expect steady growth over the next several years towards a run rate of 900,000 ounces per year. Longer-term, we see excellent potential to grow production to one million ounces per year through a further expansion of the Island Gold District. Nearly all of this growth is in Canada, it’s all lower cost, and it’s all fully funded providing one of the strongest outlooks in our sector”

Keep reading with a 7-day free trial

Subscribe to Resourceful Insights to keep reading this post and get 7 days of free access to the full post archives.