Endeavour Mining - Free cash flow Tsunami

Strong low cost mine portfolio sets up boom in production margins and shareholder dividends and share buy backs. Will valuation multiple's rerate?

Since August 2024, a disconnect seems to have developed between the soaring price of gold and the valuation assigned to Endeavour Mining. I have previously profiled Endeavour in this newsletter (see XX ), but want to further highlight what I believe is undervaluation versus their current and near term high performance.

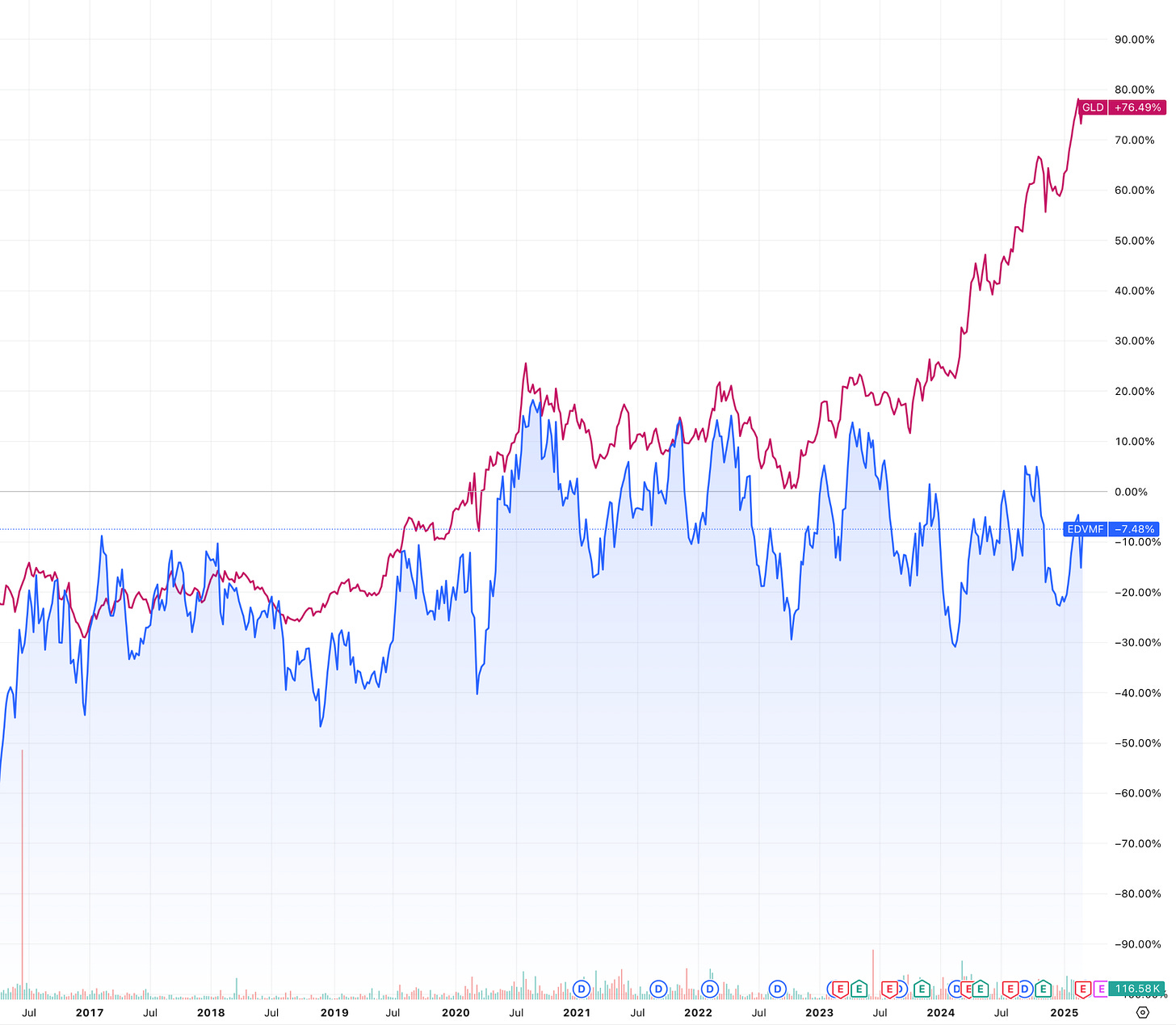

The charge below portrays the percentage change over the last 5 years for Endeavour compared to the price of the gold etf GLD. The disconnect in Endeavour (blue line) share price versus the price of gold (red line) has become pronounced, as Endeavor’s share price has remained relatively flat compared to the vaulting gold price.

For Endeavour, I believe the ‘past is unlikely to be prologue’ for the share price performance going forward.

A number of factors support Endeavour’s strong position in the prolific gold mining region of West Africa.

dominant producer in the west Africa region

has diversification across 5+ producing mines

enjoys industry leading gold production costs

an optimized portfolio of long life lower cost mines

largest exploration exposure in West Africa

Notably in 2024 / 2025 just as its mining profit margin from mining operations has followed gold higher, Endeavour has also transformed from its ‘organic growth / investment’ phase into a new phase of growing free cash flow and shareholder returns.

The combination of factors of ( 1 ) ramping down new capital expenditure investments, ( 2 ) while ramping up new mine production, and ( 3 ) nicely widening mining margins, together produce the potential for rapid growth in free cash flow and share holder dividends and share buybacks.

Keep reading with a 7-day free trial

Subscribe to Resourceful Insights to keep reading this post and get 7 days of free access to the full post archives.