Growing Producer share prices Outpacing price of Gold.

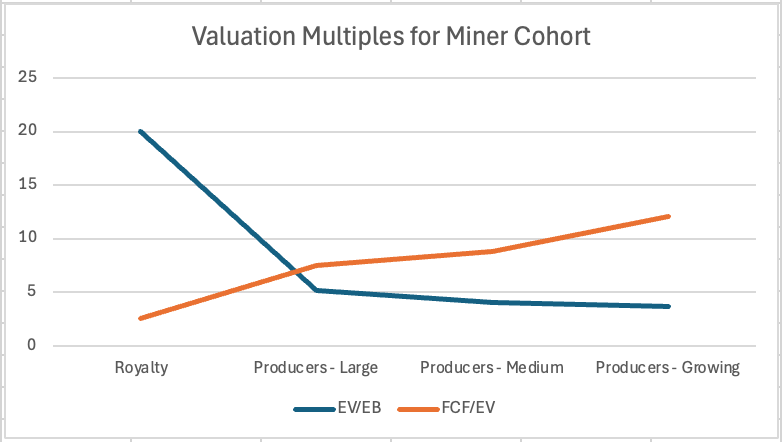

Valuation multiples vary significantly across Royalty Companies and Large, Medium and smaller Growing producers. One cohort especially is out performing.

Investors in precious metal producers can pick among differing ‘cohorts’ of miners similar in size and state of development.

Royalty, such as Franco Nevada (FNV), Wheaton (WPM), Sandstorm (SAND) etc.

Large Producers: Agnico (AEM), Barrick (GOLD), Newmont

Medium Producers: Alamos (AGI), Endeavour (EDVMF), Equinox (EQX)

Growing Producers: K92 Mining (KNTNF), Torex (TORXF), Artemis (ARGTF)

These cohorts are awarded varying valuation by the stock market, as shown in the chart below. EV/EB = Enterprise Value / EBITDA. FCF/EV = Free Cash Flow / Enterprise Value

The stock market is disproportionately awarding one producer cohort the highest cash flow yield on enterprise value.

Keep reading with a 7-day free trial

Subscribe to Resourceful Insights to keep reading this post and get 7 days of free access to the full post archives.