McEwen Mining has entered new growth phase

Stars are lining up well for MUX--as its gold projects grow and as its giant Los Azules copper project PFS is released, gets RIGI approval, and McEwen Copper IPOs

Resourceful Insights profiles companies that are advancing opportunities for production growth of precious and critical metals as their prices move higher — which should leverage the combined leverage of production and price rises.

In the case of more complex “Growth Producers”, such as McEwen Mining (MUX), there are multiple threads of activity — that include optimizing several growing gold production operations while also advancing a major copper project toward eventual production.

McEwen Mining’s portfolio of gold production opportunities, and gold exploration activities, are diversified across its Fox Complex in Canada’s Timmins gold camp, and its Gold Bar Complex and Timberline Eureka projects in Nevada’s Battle Mountain trend.

McEwen’s major copper project, Los Azules, is located in the newly mining friendly Argentina in the Salta province.

Assessing McEwen Mining’s overall potential requires understanding their combination of multiple moving pieces, the capital investment requirements and the overall economic merits.

Before long we’ll be looking back at the transformative events of 2025/ 2026, i.e.

Ramping of Fox & Gold Bar complex’s combined production to 100,000 oz gold

Large re-valuation of McEwen Copper as it IPOs

Both these events will drive substantial re-rating of parent McEwen Mining.

McEwen Mining’s portfolio of Gold production and exploration.

In Canada, at McEwen’s Fox Complex, re-development is enabling a new chapter of growing profitable gold production by

bringing online the new Stock mine and mill

extending life of the existing Froome mine

advance exploration of Grey Fox project.

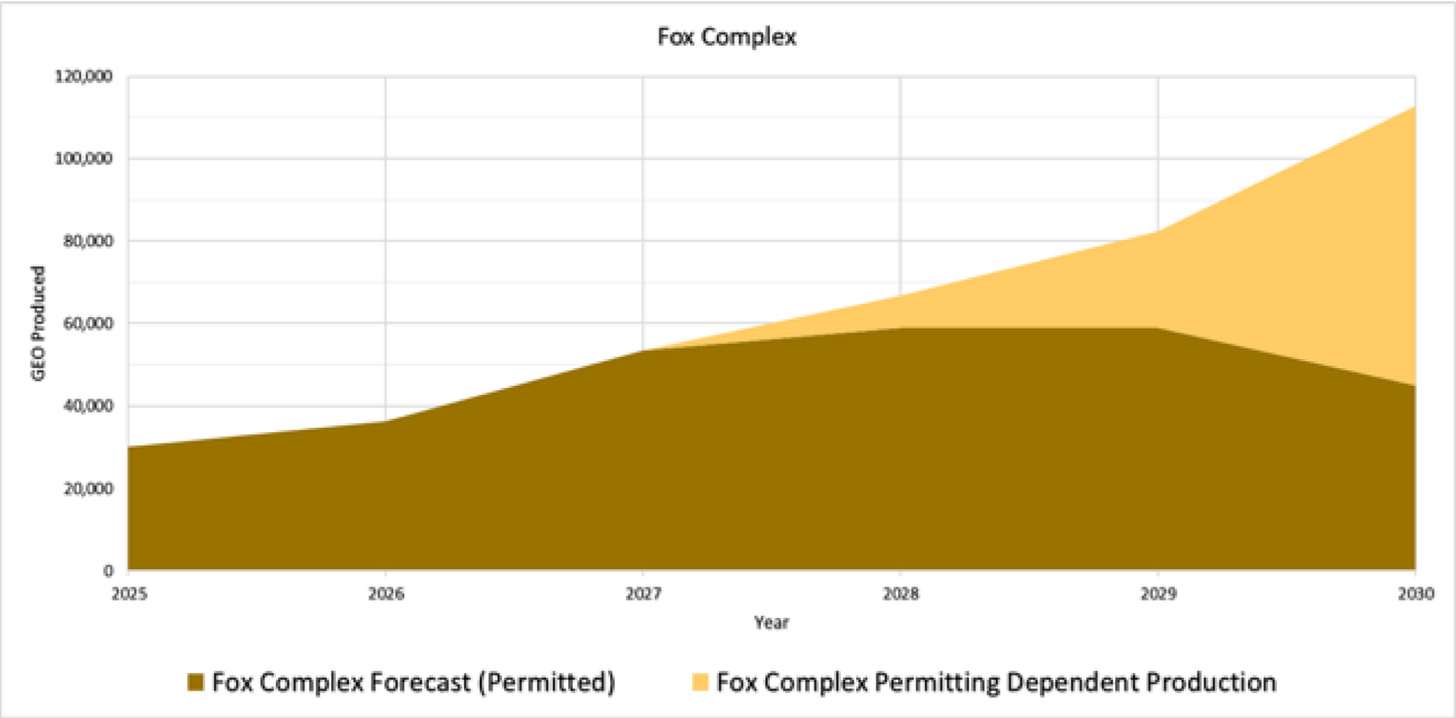

Taken together these initiatives should growth in production from Fox Complex toward 60,000 ounces gold by 2026 with growth to 100,000 ounces by 2030. The charts below is from McEwen’s shareholder annual meeting.

In Nevada, at McEwen’s Gold Bar Complex and Timberline Complex, production growth will be driven by mine

development / optimization of the Gold Bar Complex

exploration and mine development at Timberline

This production growth from all the above sources will establish MUX as a solidly growing mid-tier gold producer with mounting free cash flow. Plausible scenarios from MUX are:

‘conservative’ at $2,800 /oz gold, Cashflow grows from US$ 20,000,000 in 2025 to US$ ~200,000,000 in 2030

‘big blue sky’ $3,900 / oz gold, Cashflow grows from US$ 70,000,000 in 2025 to US$ ~350,000,000 in 2030.

Under either Scenario, MUX’s rising production in a strong gold price environment produces burgeoning cash flow!!!

Under these growth scenarios, which are only for MUX’s direct gold production, valuation at 10x free cashflow could be worth ~US $2,000,000,000 ( i.e. US $2 Billion ) by 2027 and almost double that by 2030 - say US $3.5 Billion.

These possible values are far above MUX’s present share market cap of US$ 593 million (3July’25)

With MUX’s gold operations providing solid ‘free cash flow’ beyond capital expenditure requirements, it is plausible that MUX’s direct gold production growth can be supported without additional dilutive share financings leaving MUX’s share count at about 59.6 million shares.

Using MUX’s 2027 estimated value of US$ 2 Billion from its direct production of gold, this would imply a share price of about US $33.00 or about triple the $10.99 share price as of July2, 2025.

Yet, Wait There is Much More!!

Keep reading with a 7-day free trial

Subscribe to Resourceful Insights to keep reading this post and get 7 days of free access to the full post archives.